How To Report Venmo Income On Taxes

If you use PayPal Venmo or other P2P platforms for business save time. In compliance with IRS regulation IRC 6050W Venmo and other payment providers are required to report to the IRS the total payment volume received by business profile account holders whose payments meet or exceed both of these levels in a calendar year.

Biden Wants The Irs To Snoop On Your Venmo Account Americans For Tax Reform

Biden Wants The Irs To Snoop On Your Venmo Account Americans For Tax Reform

You can then download your transaction history as a CSV file by clicking the Download CSV button next to the date selection.

How to report venmo income on taxes. The P2P organization may file a 1099-k to report these transactions to the IRS. Includes ALL business and personal accounts. Nonemployee Compensation which is subject to self-employment taxes.

Additionally Anti-Money Laundering and large transactions 10000 or transactions in a short time totaling 10000 have to be reported to the Treasury FinCen. 562019 You will report it before PayPal takes its cut and then you will report their cut as an expense. Being self employed you get into business deductions that could reduce your tax liability by deducting all business related expenses.

You shouldnt rely on Venmo sending this form to you because its part of your job to take care of it. 2942019 People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

If you use PayPal Venmo or other P2P platforms for business save time with effortless expense tracking year-round with QuickBooks Self-Employed which can easily import expenses into TurboTax Self-Employed during tax time. If you have paid someone more than 600 per year you must send them and the IRS a 1099-NEC or 1099-MISC form. Read up on that or talk to an accountant.

Even if your employer refuses to properly report these payments you should report that income yourself so if they ever do get in trouble you can show you paid your taxes fair and square. 1212021 Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes. If it exceeds 600 its taxable.

Venmo will NOT send you a 1099-K form as its parent company PayPal might if you have exchanged transaction activity receipts totaling over 20000. Depending on who you pay and what for there are a few different rules the IRS expects you to follow. E-filing is free quick and secure.

Luckily for you youve made it easy on yourself by tracking your cash income throughout the year. 662019 Log into TurboTax Online and access your Tax Return through the Timeline. Financial institutions will be required to file annual reports think yet another 1099.

If for example a Venmo consumer account is used to pay employees withholding must be accounted for elsewhere. File Your Cash Income as Miscellaneous Income. 482019 Users receiving taxable receipts are still responsible for report their earnings on the applicable tax form eg.

Businesses must record every consumer account transaction separately for tax purposes. S corporate income when your agi is greater than 400k will be subject to self employment tax. 20000 USD in gross payment volume from sales of goods or services in a single year AND.

You pay tax on income. Click Statement or click here to view your transaction history. This is because this income is considered taxable and must be reported to the IRS.

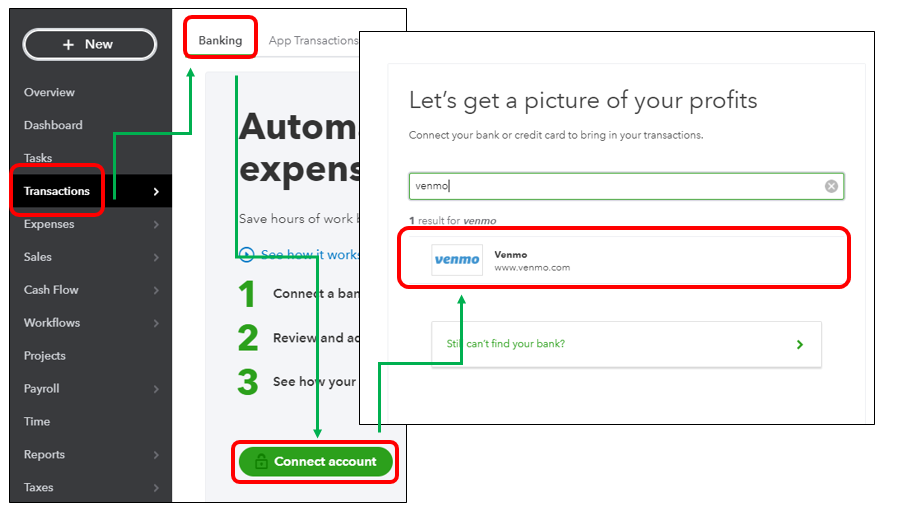

1112020 From the governments perspective Venmo activity is no different from any other transaction conducted through a traditional bank account. A person can file Form 8300 electronically using the Financial Crimes Enforcement Networks BSA E-Filing System. 2312020 Another drawback of using a Venmo consumer account is that it doesnt interface with accounting software.

From your Welcome Page in the upper right-hand corner find the Search Box and type Schedule C capital Sand C hit enter and from the search options click on Jump to Schedule C. The report recommended the IRS should work with the Treasury Departments Office of Tax Policy to consider pursuing regulatory changes that would clarify the designation of third-party settlement organizations including defining their provisions for guarantee of payment under the Tax. To view your complete transaction history or statement log into your Venmo profile from a web browser not the Venmo app.

You need to report all income regardless of how you received it Venmo check cash etc Its not an optional thing income gets reported simple as that. Report this information in Box 7. 2722021 Paying For Business Expenses With Venmo.

Other suspicious transactions also may be reported. 2842020 If youre a business owner and you decide to use Venmo to pay your workers keep an eye on the annual sum of money they earn. Schedule C Form 1065 Form 1120S etc.

If your clients are paying you through venmo bank transfer or any other method then you report that as income and pay the necessary tax on it. Despite all this not all transactions executed through Venmo are automatically taxable. Therefore you need to provide them with a 1099-MISC form.

You can use Venmo to pay for a wide range of business expenses. Payments received through Venmo must be reported on the appropriate tax returns and must be included in taxable income. The report will include gross cash inflows and outflows for each account and transfers between accounts.

2642021 Even if they dont receive a Form 1099-K the report noted that taxpayers are still required to report any taxable income on their income tax return. Includes ALL bank loan and investment accounts. As for payments made to other vendors the user remains responsible for the issuance of 1099s to eligible recipients.

It would be entered under Other Miscellaneous ExpensesBank Charges. Without good recordkeeping your payments made to contractors by Venmo. If you were a proper freelancer you would know this already.

Filers will receive an electronic acknowledgement of each form they file.

Cash App Tax Forms All Tax Reporting Information With Cash App

Cash App Tax Forms All Tax Reporting Information With Cash App

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

Tax Memo Onlyfans Content Creator Income Is Taxable Include It On Your Tax Returns Chris Whalen Cpa

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Quick Answer Does The Irs Track Cash App Merchant Account

Quick Answer Does The Irs Track Cash App Merchant Account

Irs 1099 K 2017 Fill And Sign Printable Template Online Us Legal Forms

Irs 1099 K 2017 Fill And Sign Printable Template Online Us Legal Forms

You Might Want To File Your Taxes Soon Even Though There S An Extension

Venmo Taxation What Do I Need To Know Wilkinguttenplan

Venmo Taxation What Do I Need To Know Wilkinguttenplan

Do You Need A Form 1099 Nec Or Form 1099 K

Do You Need A Form 1099 Nec Or Form 1099 K

If Your Business Uses Venmo Read This Now Mobile Law

If Your Business Uses Venmo Read This Now Mobile Law

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

How To Report Income And Pay Taxes On Your Side Hustle

How To Report Income And Pay Taxes On Your Side Hustle

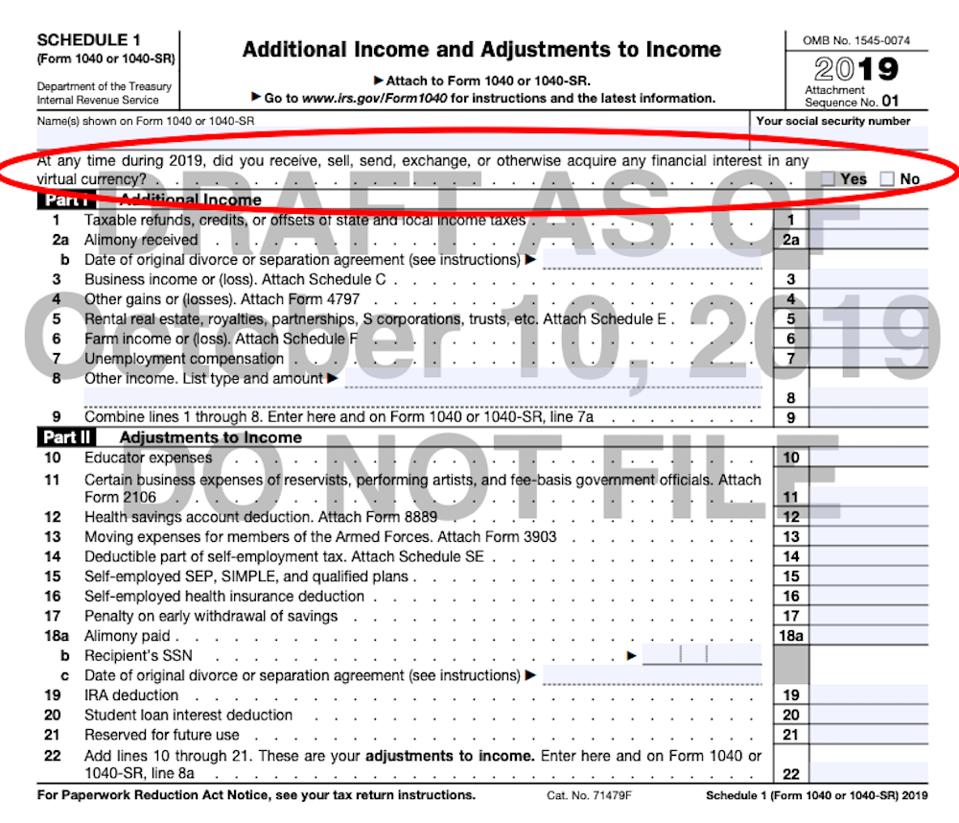

There S A New Question On Your 1040 As Irs Gets Serious About Cryptocurrency

There S A New Question On Your 1040 As Irs Gets Serious About Cryptocurrency

Paypal 1099 Taxes The Complete Guide

Paypal 1099 Taxes The Complete Guide

Post a Comment for "How To Report Venmo Income On Taxes"